Service hotline

+86 0755-83044319

release time:2022-03-08Author source:SlkorBrowse:9159

In case of conflict between the supporting policies for the integrated circuit industry and these opinions, these opinions shall prevail. If the project of "one case, one discussion" needs to implement the relevant policies of this opinion, it shall be uniformly indicated in the signing agreement and shall not be enjoyed repeatedly.

Abstract: The semiconductor industry is the core supporting industry to build China's strategic scientific and technological strength, and the semiconductor parts is the key area to determine the high-quality development of China's semiconductor industry. Although China's semiconductor industry is in the stage of accelerating development, the domestic semiconductor parts industry is still facing many problems, such as low localization rate, insufficient long-term support and investment, weak independent innovation ability of enterprises, poor upstream and downstream cooperation of the industry, lack of talent training and incentive mechanism. This paper will comprehensively summarize the development characteristics and key enterprises of the global semiconductor parts industry, study the market size and development pattern at home and abroad, and put forward relevant development suggestions for the main problems facing the domestic semiconductor parts industry at present.

01 introduction

Semiconductor parts refer to those parts that meet the requirements of semiconductor equipment and technology in terms of material, structure, process, quality and accuracy, reliability and stability. Such as O-Ring sealing Ring, EFEM (transmission module), RF Gen RF power supply, ESC electrostatic suction cup, Si silicon Ring and other structural parts, Pump vacuum Pump, MFC gas flowmeter, precision bearings, ShowerHead gas spray head. Semiconductor equipment consists of thousands of parts, the performance, quality and precision of parts directly determine the reliability and stability of the equipment, is also the key basic elements in China's semiconductor manufacturing capacity to high-end jump. The domestic semiconductor parts industry started late, the overall level of the semiconductor parts industry in China is low, the supply capacity of high-end products is insufficient, and the problem of poor product reliability, stability and consistency is increasingly prominent. In increasingly complex global macro political and economic, the suppression of containment strategy under the background of the rise of high technology industry in China is thetime "phenomenon is more prominent, which not only restricted to the development of high-grade high-end semiconductor industry in China, to the digital economy in China, the people's livelihood economy and national defense security also brings the risk of cannot be underestimated.

02 Main classification and main characteristics of semiconductor parts

(1) Main classification of semiconductor parts

Semiconductor parts are the key components of semiconductor equipment. According to incomplete statistics, the classification of semiconductor parts in the industry has not yet formed a standard, and there are mainly the following classification methods.

According to the internal process of typical IC equipment cavity, parts can be divided into five categories: power supply and radio frequency control, gas transport, vacuum control, temperature control, transmission device. The power supply and rf control category includes RF generator and matcher, DC/AC power supply, etc. Gas transportation mainly includes flow controllers, pneumatic components, gas filters and so on. Vacuum control category includes dry pump/cold pump/molecular pump and other vacuum pumps, control valve/pendulum valve and other valves, pressure gauge and O-ring seal Ring. Temperature control includes heating plates/static cups, heat exchangers and lifting components. Transmission devices include mechanical arm, EFEM, bearing, precision track, stepper motor, etc.

According to the main materials and functions of semiconductor parts, they can be divided into twelve categories, including silicon/silicon carbide parts, quartz parts, ceramic parts, metal parts, graphite parts, plastic parts, vacuum parts, seals, filtration parts, moving parts, electronic control parts and other parts. Among them, various categories of parts also include a number of subdivided products, such as vacuum parts, including vacuum gauge (measuring process vacuum), vacuum pressure gauge, gas flow meter (MFC), vacuum valve, vacuum pump and other key parts.

According to the service objects of semiconductor parts, semiconductor core parts can be divided into two types, namely precision machine parts and general purchased parts [1]. Precision machine parts are usually designed by the engineers of each semiconductor equipment company, and then outsourced processing, will only be used for their own company's equipment, such as process chamber, transmission chamber, etc., relatively easy to domestication, generally on its surface treatment, precision machining and other technology requirements are high; General purchased parts are some general parts that have been verified for a long time and widely recognized by many equipment factories and manufacturers. They are more standardized and will be used by different equipment companies and also used as spare parts and consumables in the production line. For example, silicon structural parts, O-Ring sealing Ring, valves, gauges, pumps, Face plate, gas Shower head, etc., are difficult to be localized due to their strong versatility and consistency, and need to be certified by equipment and manufacturing line.

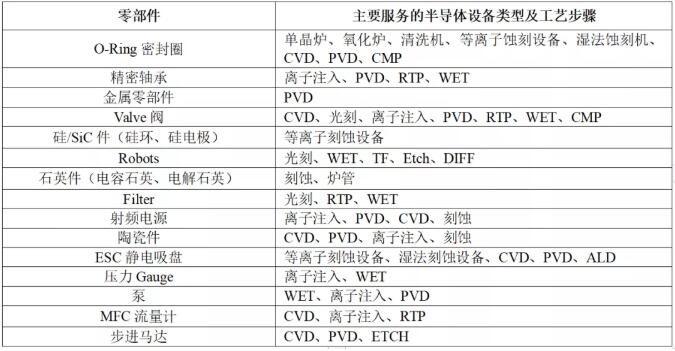

Table 1-1 summarizes the major component products and semiconductor devices that are used in a large number of devices and production lines.

Table 1-1. Main components and semiconductor equipment for main services

(Data source: Network information collation)

(2) Main characteristics of semiconductor parts industry

Semiconductor parts industry is usually characterized by high technology intensive, interdisciplinary integration, small and scattered market size, but it plays an important role in the value chain. Generally speaking, equipment parts account for about 70% of the total equipment expenditure. Take the etching machine as an example, ten key components account for 85% of the total equipment cost. It is the key support for the survival and development of the semiconductor industry, and its level directly determines the basic level of China's semiconductor industry innovation.

A. Technology intensive, high requirements for accuracy and reliability.

Compared with the basic parts of other industries, semiconductor parts, because they are used in precision semiconductor manufacturing, have the characteristics of high precision, small batch, many varieties, special size, complex process, extremely demanding requirements, etc. Due to the particularity of semiconductor parts, enterprises often take into account the composite functional requirements such as strength, strain, corrosion resistance, electronic characteristics, electromagnetic characteristics and material purity. The same parts, if possible in used in the traditional industries, but in the semiconductor industry, the key parts in the purity of raw materials, raw material batch consistency, quality stability, control accuracy, edge chamfering, deburring, surface roughness and control, special surface treatment, clean washing, vacuum dust-free packing, lead time requirement is higher, It creates a very high technical barrier. For example, as the line width of semiconductor processing becomes smaller and smaller, the photolithography process is extremely strict in controlling minimal pollutants. It not only strictly controls the particles, but also the metal ion precipitation of filter products, which puts forward high requirements for the production and manufacture of semiconductor filter parts. At present, the precision of semiconductor filter element is required to reach 1 nanometer or even below, while the precision in other industries is required to be in the micron level. At the same time, the semiconductor filter also needs to ensure the consistency, as well as chemical and heat resistance, strong resistance to shedding, so as to achieve the semiconductor manufacturing needs repeatable high performance, consistent quality and ultra-pure product cleanliness and other high requirements.

B. Interdisciplinary integration, high requirements for compound technical talents.

There are many kinds of semiconductor parts, covering a wide range and a long industrial chain. Its R&D, design, manufacturing and application involve interdisciplinary and multi-disciplinary integration of materials, machinery, physics, electronics and precision instruments, so there is a great demand for interdisciplinary talents. Take the electrostatic chuck used to fix the wafer in semiconductor manufacturing as an example. Alumina ceramics or aluminum nitride ceramics are used as the main material, but other conductive materials need to be added at the same time to make the overall resistivity meet the functional requirements, which requires a good understanding of the thermal conductivity, wear resistance and hardness of ceramic materials. In order to obtain the basic raw materials to meet the technical specifications of semiconductor manufacturing; Secondly, the internal organic processing structure of ceramic requires high precision, and the combination of ceramic layer and metal base needs to meet the requirements of uniformity and high strength. Therefore, the structural design and processing of electrostatic chuck requires skills and knowledge in precision machining. And the surface treatment of the electrostatic chuck to reach about 0.01 micron coating, at the same time to high temperature resistance, wear resistance, service life is more than three years, therefore, the master of surface treatment technology and application requirements are relatively high. It can be seen that the composite and cross-type technical talents are the basic guarantee of the semiconductor parts industry.

C. The fragmentation is obvious. The international leading enterprises mainly adopt cross-industry multi-product line development and m&a strategy.

Compared with the semiconductor equipment market, the semiconductor parts market is more segmented and fragmented. The market space for a single product is small and the technical threshold is high, so there are few pure semiconductor parts companies. The international leading semiconductor components enterprises usually take cross-industry multi-product line development strategy, and semiconductor components are often just one of the businesses of these large component manufacturers. MKS Instruments, for example, has a major market share in gas manometers/reactors, RF/DC power supplies, vacuum products, and robotic arms. In addition to semiconductor applications, MKS instruments is widely used in industrial manufacturing and life and health sciences. Continuous mergers and acquisitions and integration are also the main means for international leading semiconductor component companies to expand their scale. For example, Atlas (Atlas Copco, Sweden), an international leading industrial equipment company, has been continuously expanding its semiconductor vacuum pump business after acquiring Edwards in 2014. In 2016, Atlas acquired Leybold Germany, another leader in the field of vacuum technology, and set up a separate vacuum technology department in 2017. In July 2019, Atlas acquired the cryogenic business of Brooks again. The acquisition, which includes the cryopump operating company and Brooks' 50% stake in Ulvac Cryogenics, further strengthens the global competitiveness of its vacuum business in the semiconductor sector.

03 Market size and development pattern of semiconductor components

(1) Scale and pattern of global semiconductor components market

The global semiconductor parts market mainly consists of two parts according to different service objects. First, parts and related services customized or purchased by global semiconductor equipment manufacturers. According to VLSI, the subsystem market for semiconductor equipment was nearly $10 billion in sales in 2020, with maintenance and support services accounting for 46%, component product sales for 32%, and replacement and upgrade for 22%. Second, parts and related services directly purchased by global semiconductor manufacturers as consumables or spare parts. According to Xinmou data [2], in 2020, the purchase amount of front-line equipment components for 8-inch and 12-inch wafer lines in Mainland China exceeded $1 billion. China's manufacturing capacity accounts for about 12-15% of the world. Considering the procurement demand for high value-added components brought by advanced technology, the global procurement amount of components for 8-inch and 12-inch wafer line front-line equipment is at least more than $10 billion. Therefore, when the two parts are combined, the global semiconductor parts market can be estimated at $20 billion to $25 billion or more.

Although the overall size of the semiconductor parts market is only less than 5% of the global semiconductor market size of nearly $500 billion, the value of parts is usually dozens of times its own price, which has a strong industrial radiation capacity and influence. In addition, the key technology of semiconductor components reflects the technological level of a country's industry and semiconductor equipment, and has a very important strategic position. Its technological progress is the prerequisite for technological innovation in the downstream digital economy and information application industry.

According to VLSI data [3], ZEISS (Optical lens), MKS instruments (MFC, RF power supply, vacuum products), Edwards (vacuum pump), Advanced Energy (RF power supplies), Horiba (MFC), VAT (vacuum valves), Ichor (modular gas delivery systems and other components), Ultra Clean Tech (sealing systems), ASML (optical components) and EBARA (dry pumps).

Table 2-1. Ranking of the world's top 10 semiconductor component manufacturers

(Data source: annual report of each company, network information collation)

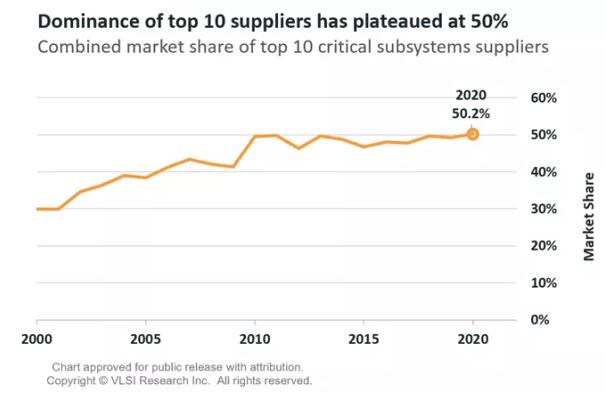

According to the VLSI data in Figure 2-1, the total market share of the top ten suppliers tends to be stable at about 50% in the past 10 years. But due to the strict requirements of semiconductor components for precision and quality, in terms of a single semiconductor components, the world is only a few suppliers can provide products, it also led to the although semiconductor components around the industry concentration ratio is only 50%, but category segment concentration often above 80% to 90%, monopoly effect is obvious. For example, in the field of electrostatic sucker, it is basically dominated by American and Japanese semiconductor enterprises (see Table 2-2), accounting for more than 95% of the market share, mainly including AMAT (Applied Materials), LAM (Panlin Group), and Shinko (Nippon Electric), TOTO and NTK (Japanese enterprises).

Figure 2-1. The market share of the world's top 10 semiconductor component manufacturers remains stable at around 50% (data source: VLSI)

Table 2-2. List of global leaders in major component products

(Data source: Jiangfeng Electronics, network information collation)

(2) Market scale and pattern of Semiconductor components in China

At present, China's semiconductor parts industry is still in its infancy and the overall scale is small. According to Xinmou data [2], in 2020, Chinese local wafer manufacturers (mainly including SMIC, Huahong Group, China Resources Microelectronics, Changjiang Storage, etc.) purchased parts of 8-inch and 12-inch front-channel equipment at a cost of about $430 million. But demand for semiconductor components is expected to remain strong due to the rapid expansion of China's domestic wafer manufacturing capacity, which is expected to add 50% of new capacity by 2023. It is estimated that the market size of semiconductor parts in China will exceed 8 billion yuan in 2023 and 12 billion yuan in 2025, according to the procurement demand of equipment and parts in production line.

Despite the rapid growth of the domestic semiconductor parts market, the technical capacity, process level, product accuracy and reliability of domestic parts enterprises are far from meeting the needs of domestic equipment and wafer manufacturers, and the overall localization rate is still at a low level. Generally speaking, for the use of customized design production of precision machine parts, China's localization rate is relatively high. Because domestic semiconductor equipment in the initial stage, in order to achieve mass production as soon as possible to catch up with the advanced level, often use their own design, and then let foreign (mainly Japan, a small number of South Korea) processors processing mode. Because of semiconductor equipment precision machining pieces of raw materials, processing methods, surface treatment and cleaning packaging have special requirements, domestic processors can't meet, in addition, because Japan processing technology providers with the types of parts processing has a rich experience, can be found in the process of machining some errors in the design and adjust. Later, with the gradual expansion of the domestic market, in order to reduce costs and ensure supply chain security, a small number of domestic semiconductor equipment manufacturers began to gradually cultivate processors in other industries began to devote themselves to semiconductor equipment precision parts processing. Therefore, in the field of precision machine parts, which is dominated by equipment manufacturers, domestic component manufacturers have made rapid progress. But for the more standardized, highly dependent on market competition for general purchased parts, the localization rate is generally very low. The main reason is that the design and production requirements of these general purchased parts are very high. Even if the sample parts of domestic products can reach the same level, they still need to make efforts to ensure the stability of mass production. At the same time, because domestic equipment enterprises have just made progress in localization, they are still passive in the procurement of general parts, mainly focusing on domestic mature products, and unwilling to boldly try domestic newly manufactured products [1].

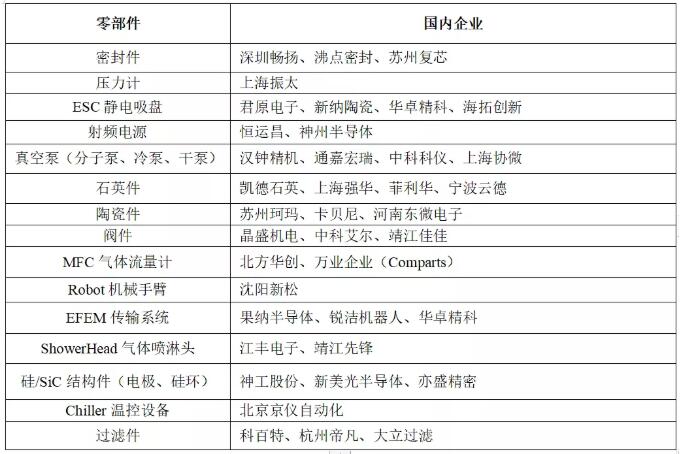

These are the main reasons why China still cannot achieve "autonomous and controllable" in the core products of semiconductor parts. According to the domestic mainstream OEM data, the annual daily operation of the received parts (including maintenance replacement and failure replacement parts) reached more than 2,000, but the domestic market share is only about 8%. The U.S. and Japan had 59.7 percent and 26.7 percent, respectively. In fact, the high-end parts market is mainly occupied by American, Japanese and European suppliers; The low-end parts market is mainly occupied by Suppliers from South Korea and China's Taiwan. The electrostatic sucker is a key non-consumable part of the wafer factory, and the unit price is as high as tens or even hundreds of thousands of DOLLARS. At present, no domestic enterprise can make relevant mature products, even the aluminum nitride ceramic raw materials used for the electrostatic sucker are far from the required technical indicators, and the external dependence is more than 99%. In addition, although the scale of vacuum pump industry in China has reached nearly 200 billion yuan, high-end products of Edwards and other enterprises still need to be imported for dry vacuum pumps for semiconductors. However, in recent years, with the acceleration of the new capacity and expansion of the domestic semiconductor industry, and the continuous delay of foreign parts delivery due to the obstruction of logistics and transportation services caused by the COVID-19 pandemic, some Domestic semiconductor parts companies with high growth potential have the opportunity to accelerate the replacement of domestic semiconductor parts. For example, The ShowerHead and cavity processing business of JIANGfeng Electronics, the filter business of Cobetter, and the dry vacuum pump business of Tongjia Hongrui. Table 2-3 summarizes some Chinese enterprises in different fields of semiconductor components.

Table 2-3. Main domestic semiconductor component companies

(Data source: Network information collation)

04 The main problems of semiconductor parts localization

(1) Lack of attention to parts and components, industrial support policies out of place

The total scale of the semiconductor parts industry is in the billions. Compared with the core industrial chain of semiconductors, the volume is smaller, the product varieties and specifications are various, the leading enterprises are few, the industrial concentration is low, and the existing technical problems are scattered, so it has not been paid enough attention for a long time. Since 2014 in our country will promote the development of semiconductor industry rose to national strategy, then at least more than 30 local government introduced a policy support to promote the development of semiconductor industry [9], but both national and local level, the policy focus more on the design, manufacture, testing, equipment, materials, semiconductor parts industry rarely covered. In terms of capital, parts and components enterprises are rarely favored by capital. The national IC Industry Investment Fund currently invests less than 100 million yuan in semiconductor parts. By the end of 2020, the total market value of listed companies mainly engaged in semiconductor parts (less than 30 billion yuan) only accounts for 1% of the total market value of all semiconductor industry chain enterprises (more than 3 trillion yuan).

(2) Relatively backward innovation ability and obvious gap in core technology

Because parts industry had not received attention for a long time, can only vulgar growth, so most of the domestic parts enterprises into the semiconductor industry is mainly to provide repair and replacement services, cleaning services is given priority to, the overall r&d, innovation ability is relatively backward, long stay at the levels of low-end production standard and copy foreign products, the core technology gap is obvious. According to the prospectus of a listed semiconductor parts company in China, there are only 15 r&d personnel, and the total r&d investment from 2016 to 2018 is less than 20 million yuan, and the average annual r&d investment intensity is less than 5%. In addition, the lack of innovation ability of China's semiconductor parts industry is also reflected in the imperfect industry standard system, the serious shortage of investment in basic process research, the lack of access to process technology, the lack of close combination of scientific research and production practice and many other problems. It restricts the innovative development of structural design technology, reliability technology, manufacturing technology and process, and basic material performance research of semiconductor components.

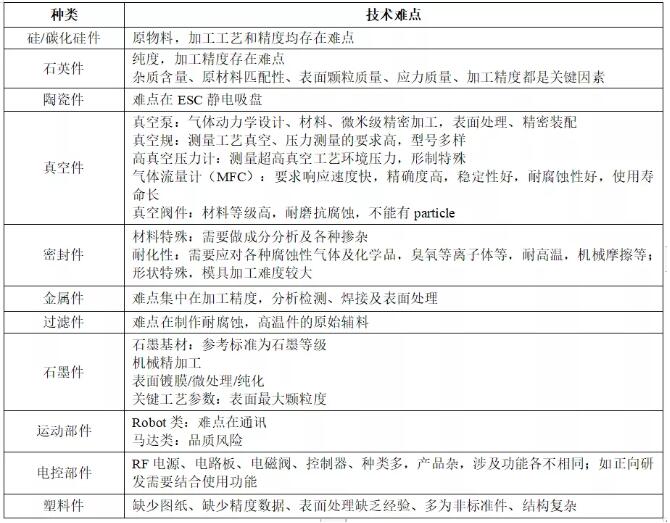

Table 2-4 main domestic semiconductor components technical difficulties

(Data source: SMIC [4], Jiangfeng Electronics [6], network information processing)

(3) Insufficient supply of craftsmen and lack of effective incentive mechanism

At present, the talent gap in China's semiconductor industry has reached hundreds of thousands of people. Although China has introduced a series of support measures in semiconductor talent training in recent years, a large number of semiconductor talent training mainly focuses on design, manufacturing, equipment and materials, and there is still a lack of attention to the talent training in semiconductor parts and other basic industries. In the basic subjects of education system reform, professional Settings, on-the-job accreditation of engineering education, technology, etc the lack of overall planning and enforcement, parts and components to a serious shortage of professional basic and professional skills curriculum, but also the lack of advocating refinement, truth-seeking, innovation, good at design, good at crucial craftsman spiritual guide [5]. In addition, the semiconductor parts industry is facing serious talent incentive mechanism is not in place. Although the overall salary level of domestic semiconductor industry personnel has been significantly improved compared with the previous, but for the mechanical processing, precision instruments, surface treatment and other industries required by parts and components enterprises, the salary of employees is generally significantly lower than the average level of the semiconductor industry. According to the prospectus of a semiconductor parts company in China, it only had 15 r&d staff before going public, and the annual salary of core technical staff was only 75,000 yuan and that of ordinary r&d staff only 30,000 yuan. The low salary level leads to serious brain drain of semiconductor parts companies, resulting in a vicious circle of lack of successors in the basic parts industry.

(4) Disjointed links of industrial chain and insufficient upstream support capacity

Semiconductor components need to undergo rigorous and complex verification procedures before they can be verified by large-scale production lines and sold on a large scale. Therefore, component manufacturers need to fully cooperate with downstream equipment and manufacturers. At present, the on-line verification procedure of semiconductor parts in China is complicated and the process is long. The coordination degree between manufacturers, equipment manufacturers and domestic semiconductor parts manufacturers is not high, and there is a lack of effective communication and interaction. As a result, both parties do not master each other's process parameters and matching ability, and the domestic substitute power is insufficient. In addition, in the process of long-term product iteration, existing foreign component manufacturers have formed a large number of know-how. However, in the subsequent imitation and trial production process, domestic manufacturers can only achieve similar appearance. Due to lack of experience and key technologies, they are eliminated in the initial verification and cannot enter large-scale application [5]. In addition, domestic semiconductor component manufacturers cannot obtain support from raw materials and production equipment and other supporting links, which also affects the competitiveness of their products. Semiconductor parts are generally a variety of products with high processing accuracy requirements, which require high raw materials and processing equipment for the production of these parts and are expensive. Due to the influence of the long-formed idea of "heavy mainframe, light supporting", China's industry has seriously insufficient investment in the upstream and downstream supporting fields of parts, leading to the gap between China and foreign countries in the raw materials and production equipment of parts. For example, the high precision machining center commonly used in semiconductor metal parts in China lags behind foreign countries in machining accuracy, machining stability, geometric flexibility and other aspects. For example, aluminum alloy, tungsten and molybdenum, as well as high purity quartz sand, the raw materials for high-end metal parts manufacturing, are basically monopolized by American and Japanese companies. The monopolistic supply of raw materials makes downstream material suppliers/processors/users limited to passive. The main quartz glass material (tube/rod/anchorage) is also from the United States, Germany, Japan companies. For a long time, the lack of upstream processing equipment and raw materials has led to the operation of most semiconductor parts enterprises in China at a low technical level. The level of raw materials and process equipment is not high, and advanced equipment is lacking and not matched, which cannot guarantee the consistency of product quality and affects the improvement of product quality.

(5) Limited manufacturing conditions affect high-end upgrading

As the semiconductor manufacturing process is often in high temperature, strong corrosive environment, so about half of the semiconductor parts need to do surface treatment to improve their corrosion resistance. For example, the plasma etching chamber of semiconductor etching equipment is in a high density, high corrosion and high activity plasma environment. The chamber and its components are easily corroded by plasma. In order to prolong the service life of these components, anodic oxidation is often used on the surface of aluminum base materials (aluminum and aluminum alloy). The plasma can effectively reduce the corrosion of the cavity and other aluminum base materials. And China's increasingly stringent environmental requirements, for the majority of surface treatment technology such as sand blasting, spray, electroplating, anode oxidation and so on controlled development, resulting in some high-end surface treatment technology, for example micro-arc oxidation, high-end spraying, Y2O3 ceramic coatings, etc., domestic gap bigger all the time, also directly affect the parts performance and quality of products, Although Chinese manufacturers can shape Valve parts, Showerhead gas spray heads, Ceramic parts and other parts according to the drawings, their development is restricted by the foundation because they cannot solve the problems of materials and surface treatment. In addition, some cutting-edge technologies of semiconductor components are limited by the "embargo", and domestic enterprises lack drawings and precision data, which prevents them from evolving to high-end technologies. For example, low-voltage vacuum gauge produced by MKS has always had to apply for export license to purchase [6].

05 Suggestions on the development of semiconductor parts industry in China

(1) Attach importance to top-level design and guide industrial development

The semiconductor parts sector, which has long relied heavily on advanced countries such as the United States and Japan, needs to pay more attention to top-level design. Suggested by making a special semiconductor components industry development plan, the plan or roadmap, determine the long-term strategic framework of industry development, and in different periods according to the development situation at home and abroad to set up the appropriate policies and programmes to orderly guide industry development, also caused the whole society especially the marketization of capital of semiconductor components industry attention.

(2) Set up special industrial projects to stimulate innovation

In order to realize the rapid development and prosperity of semiconductor parts industry, the most fundamental is to enhance the ability of independent innovation. At present, China's semiconductor parts industry can not achieve a comprehensive guarantee of semiconductor supply chain only by imitation and tracking technology, only through independent innovation. Although some parts enterprises have been supported in special 02 [7], further efforts should be made. Recommended in the national science and technology plan separately established a special semiconductor parts industry, joint domestic semiconductor components leading enterprises, the parts of the national institutes of technology innovation platform or preparing to construct, gather strengths targeting breakthrough point and main direction, adhere to independent innovation research and development, strive to overcome a batch of key core technology industrial base, We will establish a technological innovation system in which enterprises play the leading role and the enterprises, universities, research institutes and applications are combined, and guide the research and development of cutting-edge technologies, basic technologies and key generic technologies in the field of semiconductor components at the national level.

(3) Making up policy gaps and strengthening investment guidance

Semiconductor parts industry is an industry with full market competition. Due to the small scale, large quantity and thin product profit of domestic parts enterprises, the r&d investment of new products and technologies cannot be compared with that of international large enterprises, so it is difficult to win by market competition alone. However, under the current international geopolitical background, it is necessary for the government to implement relevant special policies to guide and support, and help domestic semiconductor parts enterprises to grow rapidly. It is suggested that major products independently developed by domestic semiconductor parts enterprises should be subsidized and supported by national and local finance, intellectual property rights protection of independently designed products should be strengthened, and semiconductor parts should be included in the government's procurement catalogue for the first set. Encourage all kinds of domestic industrial funds and social capital to actively invest in semiconductor parts enterprises, and help the development of domestic semiconductor parts enterprises through the capital market.

4) Increase talent introduction and training and strengthen talent supply

Comprehensively strengthen the cultivation and introduction of engineering, research and compound talents in semiconductor parts related fields [8]. Large research institutions are encouraged to establish postgraduate education and post-doctoral workstations in the field of semiconductor parts and components, and rely on major national engineering projects and major science and technology projects to train leading talents in semiconductor parts and components engineering and technology. We advocate enterprises, schools and scientific research institutions to jointly carry out vocational education and on-the-job training, actively promote the mode of school-enterprise cooperation to jointly cultivate skilled personnel, through school-enterprise order education, centralized training, directional training or entrusted training, a large number of skilled personnel of semiconductor parts, strengthen talent supply. We will actively introduce overseas engineering technology leaders and talents in short supply through various means, encourage local governments to introduce talent policies for core technology backbone and leading entrepreneurs in the field of semiconductor components, constantly improve the talent incentive mechanism, and stimulate the vitality of industrial development.

(5) Promote the linkage of parts and ensure independent supply

Promote semiconductor based supply chain part "linkage" and completely reverse disconnect parts products and equipment, manufacturing, through the government guidance, encourage domestic fabs and equipment factory to play to the role of the large production line organization and coordination, collaborative local parts makers through JieBang 1, horse racing, directional research in a variety of ways, such as strengthen the cooperation of industry chain, Realize the coordinated development of mainframe and basic parts. Support semiconductor manufacturing or equipment engineering projects led by national or local governments, give priority to domestic semiconductor parts product verification opportunities, and give certain risk subsidies. Encourage machinery, electronics, chemical and other equipment parts manufacturers to actively expand and expand semiconductor business, based on their own technical basis, develop higher-end products to meet the needs of semiconductor equipment, further consolidate and improve product layout, and enhance the independent supply of domestic parts.

Disclaimer: This article is reprinted from "Zhu Jing", this article only represents the author's personal views, does not represent the views of Sakwei and the industry, only to reprint and share, support the protection of intellectual property rights, please indicate the original source and author, if there is infringement, please contact us to delete.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd